Servicios al cliente

Sobre nosotros

Copyright © 2024 Desertcart Holdings Limited

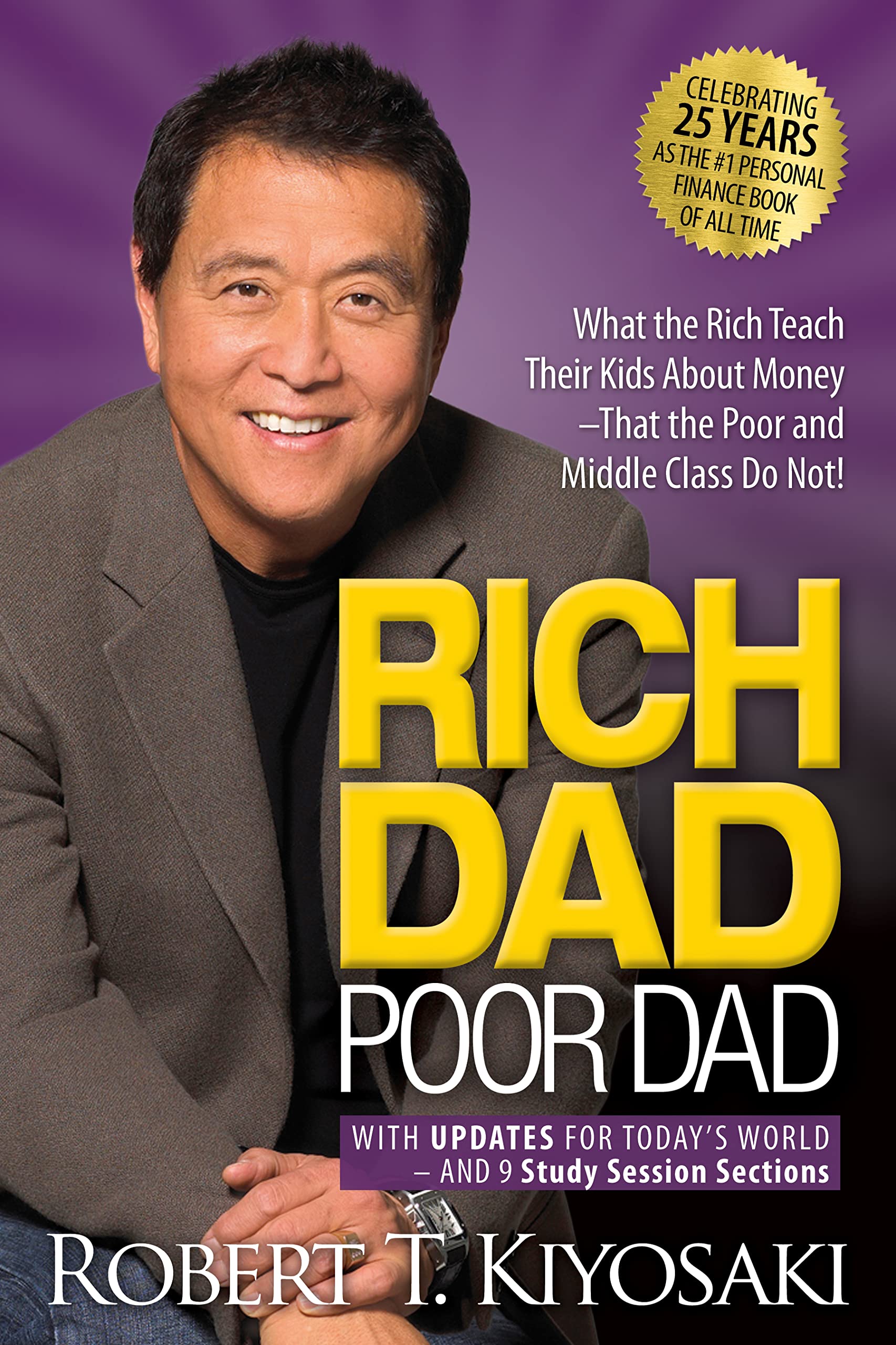

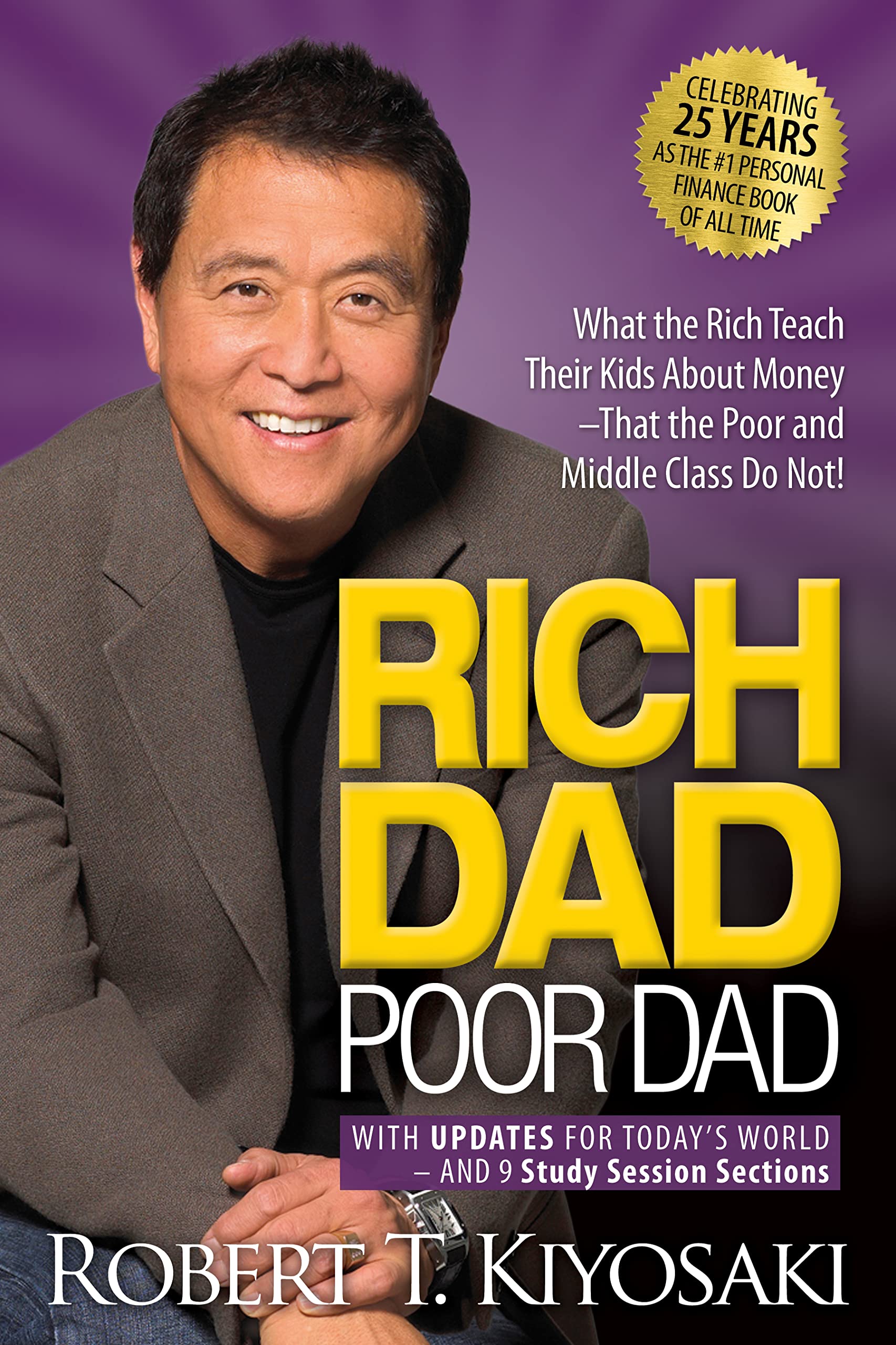

Full description not available

A**S

Game changing!

Amazing book and game changing in terms of seeing and understanding your personal finances in a different light! If you want a simple way to understand where you are today and where you can go in the future then this is the book for you! It really will give you a different perspective and meaning to the traditional views of finances and being a “home” owner. It’s also made me think differently of the traditional academic structure and what this meant for me and importantly my children as they grow.

M**D

excellent book, strongly recommended!

I was recommended this book by someone I trusted and - after reading the reviews - was quite skeptical, but - as i said - I trusted the recommendation.... I am glad I did!I cannot recall ever giving a non-fiction book five-stars!This book differs significantly from "self-help" books that are out there...it is a first-hand retelling of success, told supportingly and without hubris! It tells of lucky observations and timing and how they were capitalised on early with success ("the library" for those who have read it!) and the positive feedback loop that creates...and warns of the well meaning nay-sayers who so often (and even in my own experience) scupper what seemed - and in retrospect was - a good investment. I purchased the 20th anniversary edition which had sections on reflection and hindsight which - in such a book - are immeasurably valuable in their own right! Without regularly reflecting on the content, it just becomes a jumble of words and the messages are lost.Many of the reviews against this book bear no resemblance whatsoever to the content of the book that I read - which I read cover to cover, word for word...neither skimming nor rushing. They also seem to complain of high-cost seminars based on the book ("rich dad Seminars") etc....this is not a result of the book, but others trying to capitalise on the security/cookie-settings of the computer used to order. Indeed, within the pages, the author warns against these courses, whilst at the same time citing their value IF CHOSEN WISELY! Others actually focus on the areas that the author cautions against...i.e. being over-cautious and becoming your own nay-sayer!

K**N

Would Recommend

I found this to be a good book that increased my knowledge of financial topics

A**R

Insightful but repetitive and bloated

Overall, I enjoyed the book and would recommend it.The author is not the best writer and sometimes repeats his ideas a bit too much to the point that it feels a bit tedious. The summarises at the end of chapter mad e the book feel a bit bloated, and it would have probably been better to have 1 big summary at the end.That being said, I still belive the book is a worthy read.

K**K

Life changing

the best book I ever read and totally life changing. highly recommended! Thank you Robert for your wisdom

M**A

Eye-opening

Great book that actually explains a lot of key concepts, most importantly the mindset required to become rich. It is inspiring and will be reading the other books in the series next.

S**E

let s get rich in mind first

I chose to read this book after reading "Rich Dad, Poor Dad" and finding it a good read. Kiyosaki's ideas are great and throughout the two of his books he often refers to people having read the series. I actually think reading more than one of the books is where the issue lies, as each one is far too similar to the other and it starts to seem as though the same message is constantly on repeat. "Thats financial intelligence" and "buy real estate" etc etc.I would also point out that this is not a "get rich quick" scheme to any potential readers, its a realistic way of managing and spending your money so the title is a bit misleading. Firstly, the book pretty much revolves around using real estate to make money and if you're here in the UK than you need significant capital in the first place to even consider buying any property. Kiyosaki make money in a high paying sales job in the early days, so if you're working minimum wage today and hope this can help you then you may be in for a disappointment.Key take away from both the books I have read is how to spend more intelligently on assets that make money rather than the liabilities that dont. Its amazing the way the book makes you realise how everybody falls into the trap of earning well but having none left at the end of each pay day.I would recommend this book if you have not read the others and similarly if you havent then I would recommend buying "Rich Dsd, Poor Dad" instead.

Trustpilot

Hace 2 semanas

Hace 2 semanas